Safe Investments Offering Tax Advantages

본문

Individuals contemplating investment security often envision a sanctuary that shields their funds from market volatility, fraud, or unexpected risks

Such a sense of security gains extra value when you see how the government’s tax provisions can convert a regular investment into a potent savings engine

Merging a low‑risk outlook with compelling tax perks can expand your wealth while reducing the tax bite

This article examines the most typical secure investments that offer genuine tax advantages, the mechanics driving those benefits, and practical factors to consider when selecting the appropriate vehicle for your financial objectives

What Makes an Investment Secure?

Before we explore the tax implications, it’s important to comprehend what investors refer to as "secure." In reality, security is evaluated by three criteria: credit quality, 中小企業経営強化税制 商品 liquidity, and regulatory oversight

Credit quality denotes the probability that the issuer will return the principal and interest

Liquidity reflects the ability to convert the investment to cash with minimal loss

Regulatory oversight indicates that a government agency scrutinizes the investment, imposing rigid rules on its distribution, promotion, and handling

Typical secure investments include:

Government‑backed securities such as Treasury bonds, municipal bonds, and certain types of savings accounts

High‑grade corporate bonds issued by financially stable companies

Life‑insurance‑linked products with guaranteed cash values

Insurance‑Backed Retirement Accounts (IRA) and 401(k) plans that allow tax‑deferred growth

All of these vehicles are designed to preserve capital and provide predictable income, making them attractive for conservative investors, retirees, or anyone who needs a reliable source of funds for future obligations

Tax Advantages: The Main Attraction

The U.S. tax framework offers several key incentives that pair well with secure investments. The most frequent are:

Tax‑free income – Certain securities produce interest free from federal tax, and often from state and local taxes too

Tax‑deferred growth – Certain accounts allow money to grow without being taxed until you withdraw it, often at a lower tax rate

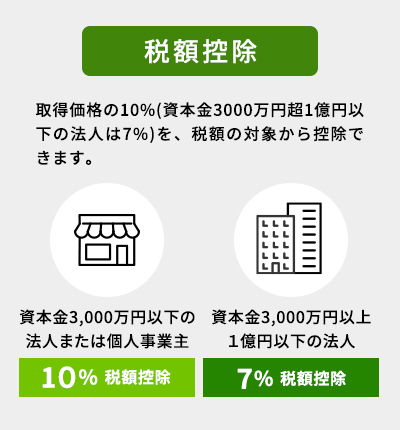

Tax credits – Some investment categories deliver direct dollar‑for‑dollar decreases in your tax bill

Charitable deductions – When you donate certain types of investments, you may be able to claim a deduction for the full market value

Below we detail the most popular vehicles that combine security with one or more of these tax advantages

TIPS: Treasury Inflation‑Protected Securities

The Treasury issues TIPS, backed by the U.S. government’s full faith and credit. They feature a fixed coupon, with the principal index‑linked to inflation through the Consumer Price Index

The primary tax advantage is that the inflation adjustment is taxed as income in the year it’s received, despite not being paid out to the investor

Consequently, you’re taxed on the principal rise even if you receive the money only at maturity

Here, the inflation adjustment is taxed at ordinary income rates, benefiting investors in lower tax brackets

Because TIPS are backed by the government and have a very low default risk, they are considered one of the safest fixed‑income options. They also provide protection against rising prices, which can erode the purchasing power of fixed‑rate bonds

Municipal Securities

Investors frequently choose municipal bonds, or "munis," for tax‑free interest. States or local governments issue them to support public works such as schools, highways, or hospitals

The interest earned on most munis is exempt from federal income tax and may also be exempt from state and local taxes if you reside in the state where the bond is issued

The safety of munis depends on the issuer’s credit rating. Investment‑grade munis have low default risk, while lower‑rated bonds yield higher returns but riskier

When in a high tax bracket, the tax exemption can yield a greater after‑tax return than a taxable corporate bond of comparable risk

I‑Bond Savings

I‑Series savings bonds provide a government‑backed, low‑risk alternative featuring a distinctive inflation‑adjusted return

{The interest on these bonds is fully exempt from state and local taxes, and if you use the funds for qualified education expenses, the interest may be completely tax‑free at the federal level|Interest from I‑Bonds is fully exempt from state and local taxes, and when used for qualified education costs,

댓글목록0